Back in 1943, Abraham Maslow, a behavioral scientist, introduced the idea of a “hierarchy of needs.” He believed that people worldwide are driven by a common set of needs organized into five levels. At the base are fundamental physiological needs like food and shelter, while at the top are higher-level desires such as self-esteem and self-actualization.

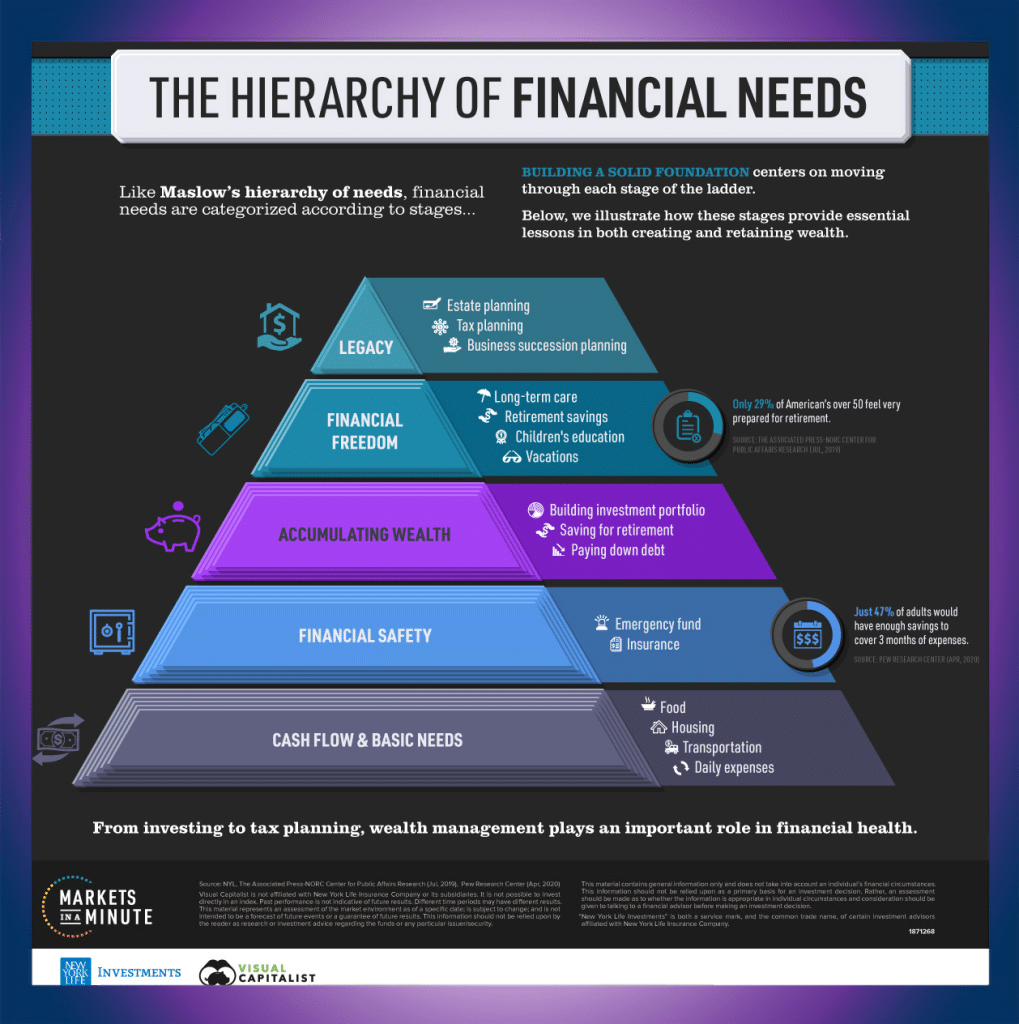

Now, New York Life Investments’ Markets in a Minute chart takes Maslow’s theory and applies it to our financial well-being, helping us build a sturdy financial foundation. Let’s break down these five levels:

- Cash Flow and Basic Needs: This level covers essentials like food, housing, and daily expenses. It ensures that our fundamental physiological needs are met financially.

- Financial Safety: Here, we focus on insurance and creating an emergency fund to prepare for unforeseen events. An emergency fund should ideally cover three months of living expenses, offering a cushion for unexpected circumstances like accidents, health issues, or job loss.

- Accumulating Wealth: This stage involves growing investments, paying off debt, and saving for retirement. The goal shifts to building assets for long-term financial security.

- Financial Freedom: Long-term care, children’s education, retirement savings, and vacations fall into this category. These financial needs align with esteem needs, such as self-respect and personal accomplishment.

- Legacy: This level encompasses estate planning, tax planning, and business succession planning, connecting with self-actualization in Maslow’s hierarchy.

While financial needs can vary based on individual situations, following this path can provide a solid roadmap for financial well-being. But how does this theory apply to our everyday lives?

For starters, people across income levels are increasingly concerned about having enough savings for retirement as life expectancy rises. In the lower income bracket, 50% worry about retirement savings, while 26% in higher income levels share the same concern.

Debt is another pressing issue, particularly with the rising costs of healthcare and education. College costs have surged 25% over the past decade, and U.S. household debt has doubled to $14 trillion since 2004.

Only when these basic needs are met can individuals focus on the top of the financial needs hierarchy, addressing legacy-focused matters like estate planning, tax strategies, or business succession.

To navigate this hierarchy effectively, a robust financial plan is crucial. It provides a framework to adapt to changing life circumstances and adjust tactics as you climb each level. Understanding your financial needs enables informed choices, from everyday purchases to long-term investment decisions, especially in uncertain times.

Source: Neufeld, Dorothy. “Visualizing the Hierarchy of Financial Needs.” Advisor Channel, Dorothy Neufeld, 17 Sept. 2020, https://advisor.visualcapitalist.com/hierarchy-of-financial-needs/.